Who else struggles with saving money? I certainly do sometimes! Let's be real, when you are working and earning that hard earned pay check, the last thing you want to do is save it. Right? You want to use it to pamper yourself because you deserve to or maybe spend it to go on this trip that you have been waiting to go on. Or maybe you and your significant other want to buy that new flat screen television that you both have had your eye on for months. Guys, as hard as it can be sometimes, it is always best to put a little money aside each month in case of emergencies where you need to take a little money out, especially when you start having other people to care for and support. Let's get one thing straight though, if you and your significant other split the payments or share an account, the biggest piece of advice that I can give you is PLEASE communicate with them about your finances and always if you make a grand purchase. Take it from someone who has come home with some pretty extravagant gifts sometimes and I didn't get the happy reaction that I thought I would get. It will save you from many fights and arguments and neither of you will be left in the dark when it comes to your purchases. I try and blog about things that I personally can relate to because I have experienced it for myself, I feel that it makes for a better writer. Because of this, I feel the need to blog about financing and money saving because it has been one of Ricky and I's biggest struggle since we started living together. Granted, we both have gotten so much better because we continue to grow and learn from our mistakes but saving money as best as we can is still an important task that we aim to achieve every day. In the beginning, Ricky and I realized that we were drowning every month not only because of the ridiculous rent payment but because we were not being smart with our spending and there were a lot of things that we could cut out that would help us save more money so we wouldn't be in such a tight situation after we paid all of our bills. I would see how mad it would make Ricky and I would be discouraged because I felt like I could have done a better job with managing our money and finances. This is when I decided to sit down with Ricky and create a monthly checklist for our finances. I wrote down a few ways to save us some money and I had faith that it would inevitably benefit us financially and help us stay afloat. I hope this can be of use to you if you can relate to this too!

Keep a money jar!

When that awesome pay day comes around, take a little of that money from your pay check and put it aside in a money jar or any place that is safe and is accessible to only you and your significant other. You don't have to put a large amount of money aside but a good twenty dollars from your pay check will be an excellent start to saving money. Eventually, you and your significant other will have put aside enough money to help with any bills or just anything that has been weighing you down financially or even have enough to go on a trip together! It's always smart to have some money set aside for when life decides to throw you it's curve balls.

Set a financial goal!

Life is always better when you are accomplishing the goals that you set for yourself, it gives us all a sense of purpose and fulfillment when we have something to work towards and fight for. Why not set a financial goal for yourself as well? Maybe write down one financial goal that you hope to accomplish for the month such as, only going out to eat twice in one month instead of once every week or saving enough money to pay off a loan or maybe make it a goal to only spend a hundred dollars on groceries for the entire month. Whatever you choose, make sure your goals are focused on growth and money management.

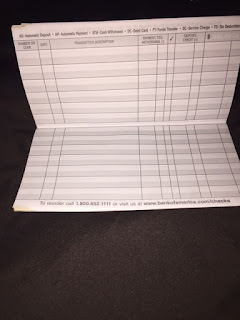

Keep a record of your spending!

Honestly, this helped me more than anything! It was very resourceful and helpful to see what we were spending the most money on because I was able to visually see what we needed to cut back on or what was the most expensive thing that was negatively impacting our finances. Because we were able to see this for ourselves every month, we were able to manage our money more wisely and in the long run, it saved us a lot of money!

* Stay happy and beautiful! :)

Comments

Post a Comment